I believe flying cars will rule the skies long before self-driving cars rule the roads. While it might seem like a sci-fi fantasy, they’re moving quickly.

Uber has set a target of test flights by 2020, and are launching in Dallas, Los Angeles, and one as-yet-unnamed international city, a title that Sydney and Melbourne are both contenders for. Successful cities will see up to 25 “Vert-ports” (landing/takeoff pads) built around their greater metro area.

Amara’s law says that “we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”. A great example here is the iPhone – it’s sometimes hard to believe that the first iPhone was only released 10 years ago.

Investors price future expectations into today’s investment decisions. So even if widespread adoption of flying cars is 10 years away, investment properties are held for around 8 years so the effects for real estate investors will be felt much sooner.

Uber is leading the charge here and when it comes to Uber’s effect on investments, history is a great guide. Uber launched in Australia in late 2012 (about a year after our founder Mina Radhakrishnan joined).

Taxi licenses halved in value in 2015, while the number of Uber users in Australia quadrupled. In fact, Uber's penetration in Australia is now higher than in the US.

So how will Uber’s ambitions affect Sydney property investors? I think there are 3 things that we should think about:

1. Distance will make the heart grow fonder

Trips will become multi-modal (e.g., an uber car picks the user up from home, takes them to the vert-port, where they get on a flying car). Therefore, like short air trips today, a large portion of total travel time will be spent on the ground. This means that a 50km flying-car journey likely will take a similar time to that of a 15km flying car journey.

That said, the 50km commuter that used to take a car/bus/train saves far more time than the 15km commuter. Given the relative value for those living further out, it’s likely that the first Vert-ports will be in locations that are farther away.

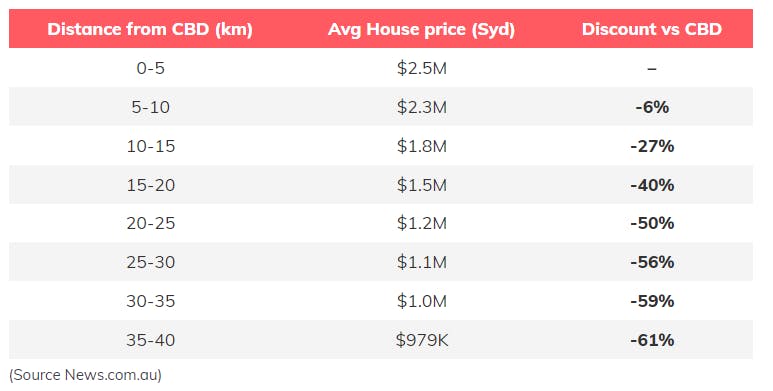

Moving 30km away today reduces property prices by 60%. Much of this is driven by commute times – the average Sydney-sider spends 7 working weeks each year stuck in traffic, including 2 working weeks in gridlock. If the commute is the same, would you rather live in a 90sqm apartment or in a 500sqm house?

2. “Flyover” suburbs

In the US, Californians and New Yorkers refer to everything in-between as a “flyover states”. Will flying cars create “flyover suburbs”?

In the flying car world, commuters can get to the city from Gosford (median house price $788K), or from the Blue Mountains (median house price $680K) faster than from Belfield (median house price $1.3M). Of course, Belfield is lovely, but I’d prefer to live by the beach for half the price and half the commute. I’m sure I’m not the only one, and that drives property prices.

"For us, local is where the customer is (even if we have to fly there!)"

3. You’re on the right track but you’re on the wrong train

Flying car trips are likely to be multi-modal – a car picks the passenger up from home and seamlessly transfers them to a vert-port. Would you rather a 20-minute commute that starts at your door, or a 90-minute bus or train ride, where you have to walk to the station/stop? I expect the relative premium paid for properties close to outer-lying transport hubs to reduce.

Uber flying cars are just another example of ‘local’ being redefined. If we can get people from one side of the metro area to another in 20 minutes, why not documents, or Chinese food?

At :Different, we too are trying to re-imagine local; when it comes to property management with a leading tech property management software to the market. For decades, Australians have relied on their local High Street agent, with franchises dotting our main streets. This remains the case even though, no one, in history, has actually wanted to go into a real estate office. For us, local is where the customer is (even if we have to fly there!).

Disclaimer: The information provided on this blog is for general informational purposes only. All information is provided in good faith; however, we do not account for specific situations, facts or circumstances. As such, we make no representation or warranty of any kind whatsoever, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information presented.

This blog may also contain links to other sites or content belonging to or originating from third parties. We do not investigate or monitor such external links for accuracy, adequacy, validity, reliability, availability or completeness, and therefore, we shall not be liable and/or held responsible for any information contained therein.

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C5562%2C3710&w=2000&h=1334)

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C4000%2C1400&w=700&h=245)